The Buzz on Dental Debt Collection

Wiki Article

The Basic Principles Of Debt Collection Agency

Table of ContentsA Biased View of Business Debt CollectionGet This Report on Dental Debt CollectionExamine This Report on Private Schools Debt CollectionA Biased View of Private Schools Debt Collection

The financial debt buyer purchases only a digital documents of details, frequently without supporting proof of the financial obligation. The financial obligation is additionally normally extremely old debt, in some cases referred to as "zombie debt" due to the fact that the financial obligation purchaser attempts to restore a financial obligation that was past the law of constraints for collections. Financial obligation collection agencies might contact you either in writing or by phone.

Not speaking to them won't make the financial obligation go away, as well as they may just try alternate techniques to call you, including suing you. When a debt collector calls you, it's essential to obtain some initial information from them, such as: The debt enthusiast's name, address, as well as contact number. The complete quantity of the financial obligation they assert you owe, including any fees and also passion charges that may have accrued.

Business Debt Collection Fundamentals Explained

The letter needs to specify that it's from a debt collection agency. They need to also educate you of your civil liberties in the financial debt collection procedure, as well as how you can challenge the financial obligation.If you do challenge the financial debt within 1 month, they should cease collection efforts until they provide you with evidence that the debt is your own. They need to supply you with the name and address of the initial creditor if you ask for that details within thirty day. The financial obligation validation notice have to include a kind that can be utilized to contact them if you desire to contest the debt.

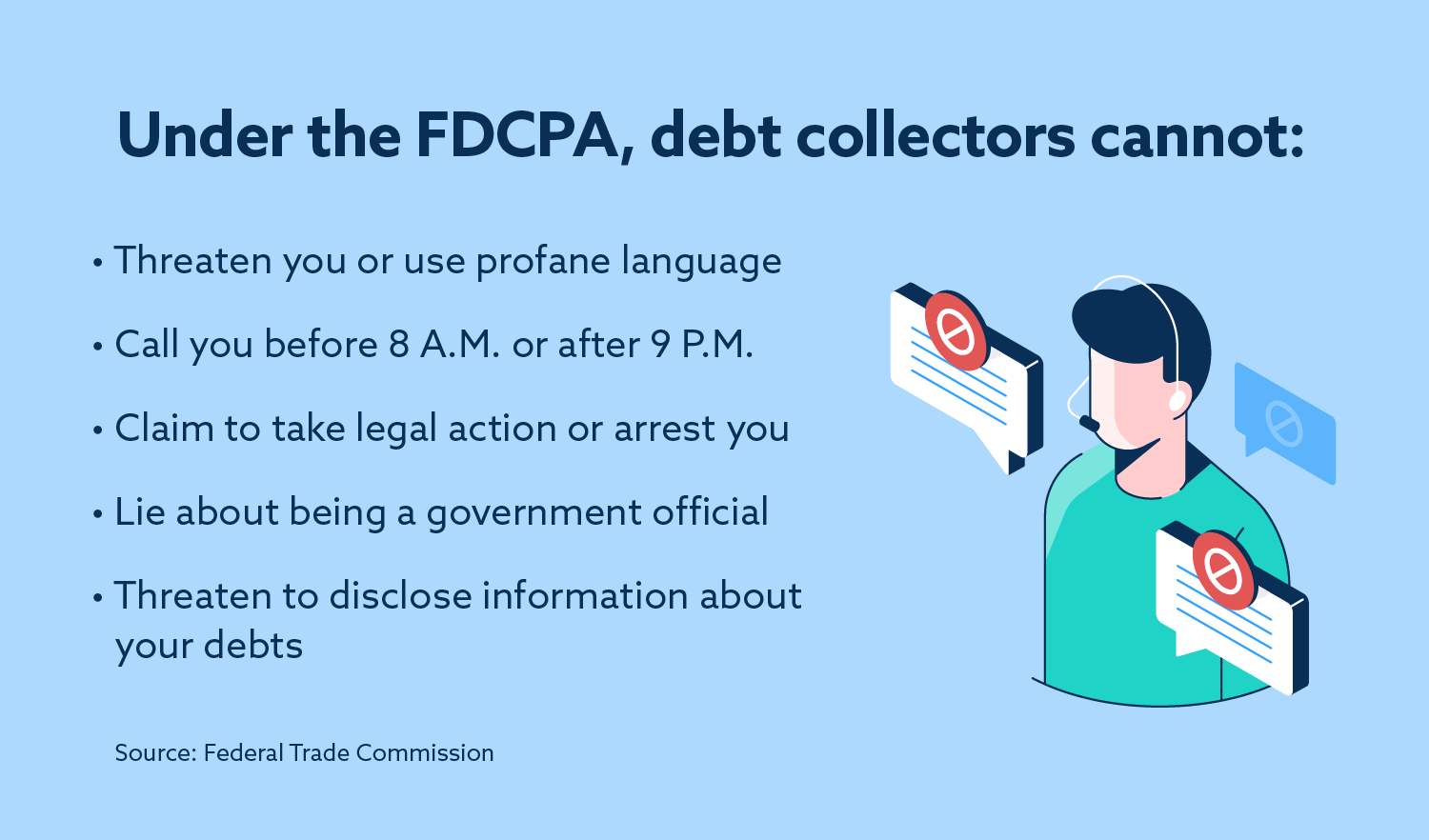

Some points financial debt enthusiasts can refrain from doing are: Make duplicated contact us to a borrower, meaning to annoy the borrower. Intimidate physical violence. Use profanity. Lie concerning just how much you owe or act to call from a main government workplace. Typically, overdue debt is reported to the credit score bureaus when it's thirty days past due.

If your financial obligation is moved to a debt enthusiast or sold to a debt buyer, an access will certainly be made on your credit scores report. Each time your financial obligation is offered, if it proceeds to go unpaid, one more entry will be included in your credit scores record. Each adverse access on your debt record can remain there for up to 7 years, also after the financial debt has been paid.

Examine This Report about Business Debt Collection

Yet what should you anticipate from a collection agency and just how does the process job? Continue reading to figure out. Once you have actually made the decision to employ a debt collector, ensure you choose the right one. If you comply with the advice listed below, you can be certain that you've employed a trusted firm that will manage your account with care.As an example, some are better at getting outcomes from bigger companies, while others are knowledgeable at gathering from home-based services. Make certain you're working with a firm that will in fact serve your needs. This may appear obvious, however before you employ a debt collection agency, you need to make sure that they are certified and also accredited to serve as debt collection agencies.

Before you start your search, comprehend read this the licensing demands for debt collector in your state. This way, when you are interviewing agencies, you can speak smartly concerning your state's demands. Get in touch with the companies you talk with to ensure they fulfill the licensing demands for your state, particularly if they are situated somewhere else.

You should additionally get in touch with your Better Service Bureau as well as the Commercial Collection Agency Organization for the names of trustworthy and also very related to debt enthusiasts. While you might be passing along these financial obligations to a collection agency, they are still representing your company. You require to know just how they will certainly represent you, just how they will certainly collaborate with you, as well as what pertinent experience they have.

Rumored Buzz on Business Debt Collection

Just because a technique is lawful does not mean that it's something you want your firm name associated with. A trusted financial debt collection agency will certainly collaborate with you to website link outline a strategy you can deal with, one that treats your former customers the way you 'd wish to be treated and still obtains the job done.If that occurs, one strategy numerous agencies make use of is miss tracing. You must likewise dig into the collector's experience. Pertinent experience boosts the possibility that their collection efforts will certainly be effective.

You ought to have a factor of contact that you can connect with and also get updates from. Business Debt Collection. They should have the ability to plainly verbalize what will be anticipated from you in the process, what information you'll need to provide, as well as what the cadence and also sets off for communication will certainly be. Your selected agency must be able to fit your selected interaction requirements, not force you to approve their own

No matter whether you win such a case or otherwise, you want to be certain that your company is not the one responsible. Request evidence of insurance coverage from any debt collector see this here to safeguard on your own. This is most commonly called an errors as well as noninclusions insurance plan. Financial obligation collection is a solution, as well as it's not an economical one.

Report this wiki page